How can we make sense of LangTech and the new emerging world of language education post-COVID19?

Michael* had been successfully running a physical language school in Italy for several locations for over 20 years. On the 9th of March 2020, Italy went into lockdown. This meant that all of their current students and teachers were forced immediately to remain home and removed the possibility of any students travelling to attend the school. The impact on the school was devastating with a fall of 70% - 80% in enrollments. In the next 30 days, thousands of school owners around the world, like Michael, had to overhaul their entire operation and business model.

This has been a wild year with so much happening due to Covid-19. The next 3 to 6 months will be critical for many language schools. There is still a high likelihood that there will be further lockdowns, whether localised or countrywide, and there will be travel restrictions that can interfere with international students travelling into the country until a vaccine is implemented worldwide.

Introducing LangTech

This is the time that language schools are being forced to disrupt themselves, which is very difficult, but necessary to survive. Students will choose schools that provide a great experience both in-person as well as online. Schools will either adapt to the market or find it hard to survive the next 6 to 24 months. Teachers are either victims of the strategic direction of the school or contributors to it. If you are a language school owner or director, covid-proofing your organisation is essential. This implies entering the online language learning market in order to survive.

Although online language education is new to many, the thing is, it is not new at all: its time has simply arrived. The market for online language learning is approximately USD $5 billion and growing around 15% - 20% per year. The online language education market was worth approximately $14 billion and grew 10% per year before Covid-19 hit; much faster than the market for in-person language education.

Covid-19 is still causing huge disruption in the world but early indicators suggest that it has been hugely negative for in-person language education companies but generally positive for prepared B2C online language education companies and likely positive for online corporate language learning companies in the medium to long-term.

We were already seeing the emergence of so-called LangTech “unicorns” (private companies worth over $1 billion), including Duolingo and VIPKid, while decade-old brick-and-mortar language companies were declining, being consolidated/acquired or collapsing. In 2010, online language learning made just 3% of the worldwide market for language learning. It is now 6 times bigger and accounts for 18% of the market. These are also pre Covid-19 figures.

Well before Covid-19 set in, I was writing a book with my co-author Brian. In it, we describe the background, the current state and the future trends of the emerging online language learning industry, which we call "LangTech".

We use "Langtech" as the umbrella description of the companies, people and programs that create or use technology to support or enable language instruction.

LangTech Product Categories

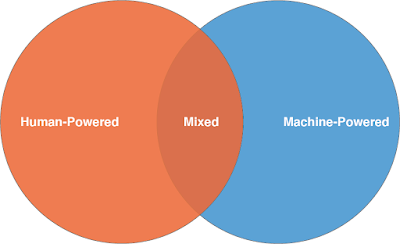

There are 3 main product categories in LangTech, each with its own product design choices, key industry players, and varying degrees of technology use:

- Human-powered instruction: Human-powered instruction is when a human being is the main driver behind the instruction delivered to the learner. While there is some “asynchronous” online instruction with learners getting feedback on their written language skills, the vast majority of human-powered online language instruction is “synchronous” (real-time communication between the teacher and student). Examples of this category include VIPKid, Lingoda and Italki.

- Machine-powered instruction: Machine-powered instruction is where a machine or computer program is the main driver behind the instruction delivered to the learner. Language instruction is delivered through the digital interface and with no direct human involvement. These days, the interface may differ substantially - web application, mobile application, virtual reality headset, augmented reality screen - but the key idea remains the same: a self-study course. Examples of this category include Duolingo and Babbel.

- Mixed instruction: Mixed instruction is a style of education in which students learn a language through combined human and machine-powered instruction. This model is particularly popular in the B2B sector of LangTech: Speexx, Learnlight, GoFluent, Babbel B2B and Rosetta Stone all follow a blended model.

Over the next few blog posts in this series, we will be looking at each one of the product categories in depth, exploring their product design choices, and providing examples of several companies and what they are doing right. We will also look at where LangTech supporters (mostly technology enablers) and educators fit in, and provide a practical framework to help you make sense of where your (current or prospective) offering stands in the LangTech space.

For now, if you're interested in continuing the conversation, please comment below!

Footnotes:

* Michael is not his real name. He preferred not to share his identity.

* Our interviews with language companies seemed to back up this optimism and since March 2020, we’ve had reports that indicate that the growth rate for B2C spiked between March and May 2020 in proportion to the hollowing out of the B2B language learning sector as businesses reduced training budgets.